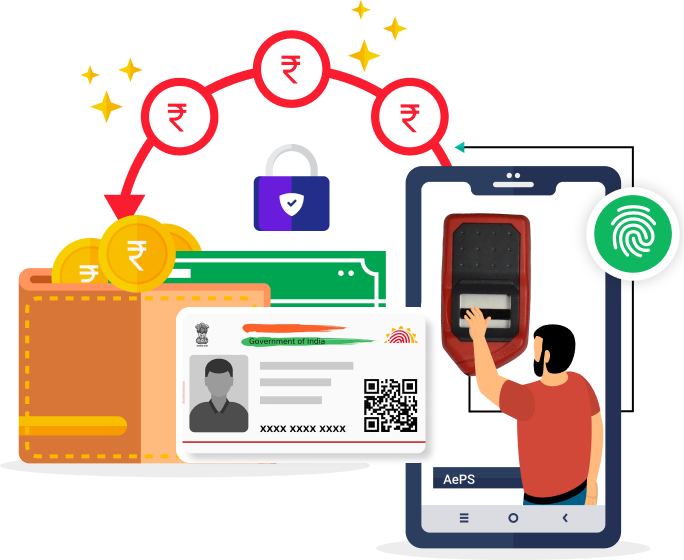

Aadhaar-enabled Payment System (AePS)

Are you looking for an easier way to manage your finances? The Aadhaar-enabled Payment System (AePS) is here to transform banking in India’s rural and remote areas. Developed by the National Payments Corporation of India (NPCI), AePS allows you to use your Aadhaar number and biometric authentication for transactions. It’s a secure and convenient way to access banking services like cash withdrawals, mini statements, and balance inquiries. AePS is leading the way in expanding Aadhaar-based banking, making financial services accessible to everyone.

Integrate AnshPe’s AePS API today and enable quick, hassle-free Aadhaar-enabled cash withdrawals, mini statements, and balance checks for your entire network. Streamline your services and enhance customer convenience effortlessly!

Who can use the AePS API?

Who can use the AePS API?